8 August 2024

What Does the Future Hold for Dubai’s Real Estate Market in 2024?

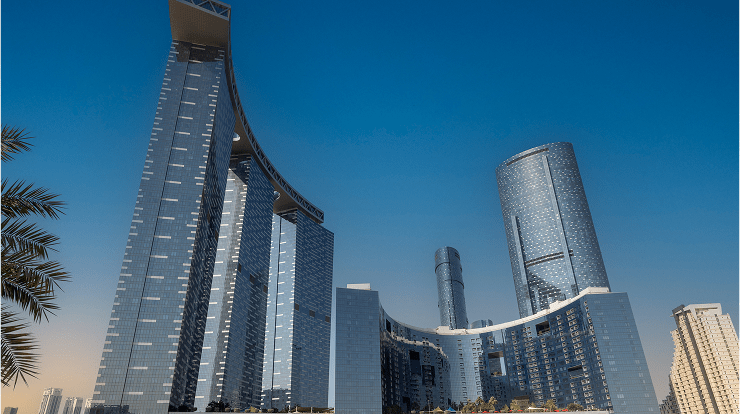

Dubai’s real estate market has always been a magnet for investors and homebuyers worldwide, known for its rapid growth, architectural marvels and luxurious lifestyle offerings. As we navigate through 2024, the market continues to evolve, shaped by a mix of supply chain challenges, rising rental rates and steady sales prices. With Q2 behind us, the question on everyone’s mind is: What will the future hold for Dubai’s real estate market in 2024 hold?

In this post, we explore the current trends and factors influencing Dubai’s property market, offering insights into what to expect as the year unfolds. Supply: A Slower Yet Steady Expansion Dubai’s real estate supply growth took a more measured pace in Q2 2024, with approximately 6,750 new residential units delivered—significantly fewer than in Q1. While developers remain committed to meeting demand, ongoing supply chain disruptions often hinder their progress by affecting materials and labour. However, some developers have managed to stay on track, leveraging well-established supply chains and efficient project management strategies. Despite these challenges, new project launches have not slowed down. From skyscrapers to master-planned communities, Dubai’s skyline continues to expand. Significant developments like Emaar’s Heights Country Club and Wellness community signal the city’s ongoing commitment to creating spaces that promote well-being and luxury living. As Dubai aligns with its ambitious 2040 Urban Master Plan, the market is expected to see a continued influx of new properties, though some may face delays.

What’s Next?

The second half of 2024 is anticipated to bring an additional 25,000 residential units to the market, although some projects might roll over into 2025. This growing supply will likely balance the market, providing more options for buyers and renters while possibly stabilising price increases.

Rental Rates: Moderation Amid Growth

Rental rates in Dubai have shown moderate increases across both apartments and villas in Q2 2024, with apartments rising by 3% and villas by 2% compared to Q1. This trend is primarily driven by the updated RERA rental index, which has allowed landlords to impose higher rent increases upon lease renewals.

However, the pace of annual rental growth has slowed to single digits—8% for apartments and 4% for villas. Luxury and niche developments aside, the upper end of the market experienced a slowdown in rental growth. In contrast, affordability is driving significant rental increases in mid-tier and budget-friendly communities like Emaar South and Damac Hills 2. These areas are attracting tenants with competitive rents, enhanced infrastructure and the flexibility offered by hybrid work arrangements.

What’s Next?

As living costs continue to rise, rental growth is expected to moderate further. However, demand for affordable housing will likely keep driving up rents in lower and mid-end markets in the short-term, making these areas increasingly attractive for both tenants and investors.

Sales Prices: Steady Gains with Strategic Hotspots

Dubai’s sales market remains robust, with Q2 2024 seeing a 2% increase in average sales prices. Certain areas, such as Jumeirah Village and Business Bay, have outpaced this average, reflecting the city’s growing appeal to both local and international buyers. In addition to the general increase in demand, this can be attributed in part to a significant rise in both off-plan launches and newly completed developments. These new projects often feature superior quality compared to earlier ones in these areas and are priced accordingly.

The off-plan market, in particular, continues to thrive, buoyed by new project launches and enhanced financing options. Developers are enticing buyers with flexible payment plans and lower down payments, while lenders are offering additional financing during construction phases. This accessibility is broadening the market’s appeal, making off-plan properties a hot commodity for investors looking for high returns in a tax-friendly environment.

What’s Next?

With new high-quality developments coming, sales prices in strategically located areas are expected to continue their upward trend. The off-plan market will likely maintain its momentum, driven by investor confidence and favourable financing conditions.

As we look ahead to the remainder of 2024, Dubai’s real estate market presents a mixed but optimistic picture. While supply chain challenges and rising costs pose potential headwinds, the market’s resilience is evident in its steady growth and the continued appeal of its diverse property offerings.

So, what does the future hold?

Expect a balanced market with ongoing opportunities for buyers, renters and investors—especially those who stay informed and adaptable to the changing landscape.

For those looking to dive deeper into these trends and understand the detailed numbers, the Q2 2024 Dubai Real Estate Market Report offers a comprehensive analysis that can help you make informed decisions.News & insights

Related news and Insights

Asteco Awarded "Property Management Company of the Year" at World Realty Congress Awards 2024

December 16, 2024

Asteco Wins Property Management Company of the Year

June 7, 2024

What Does the Future Hold for Dubai's Real Estate Market in 2024?

August 8, 2024